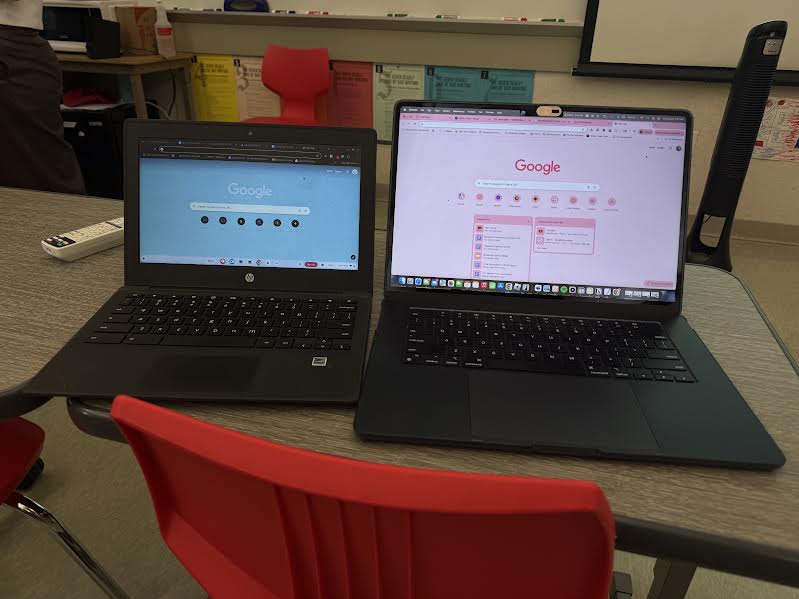

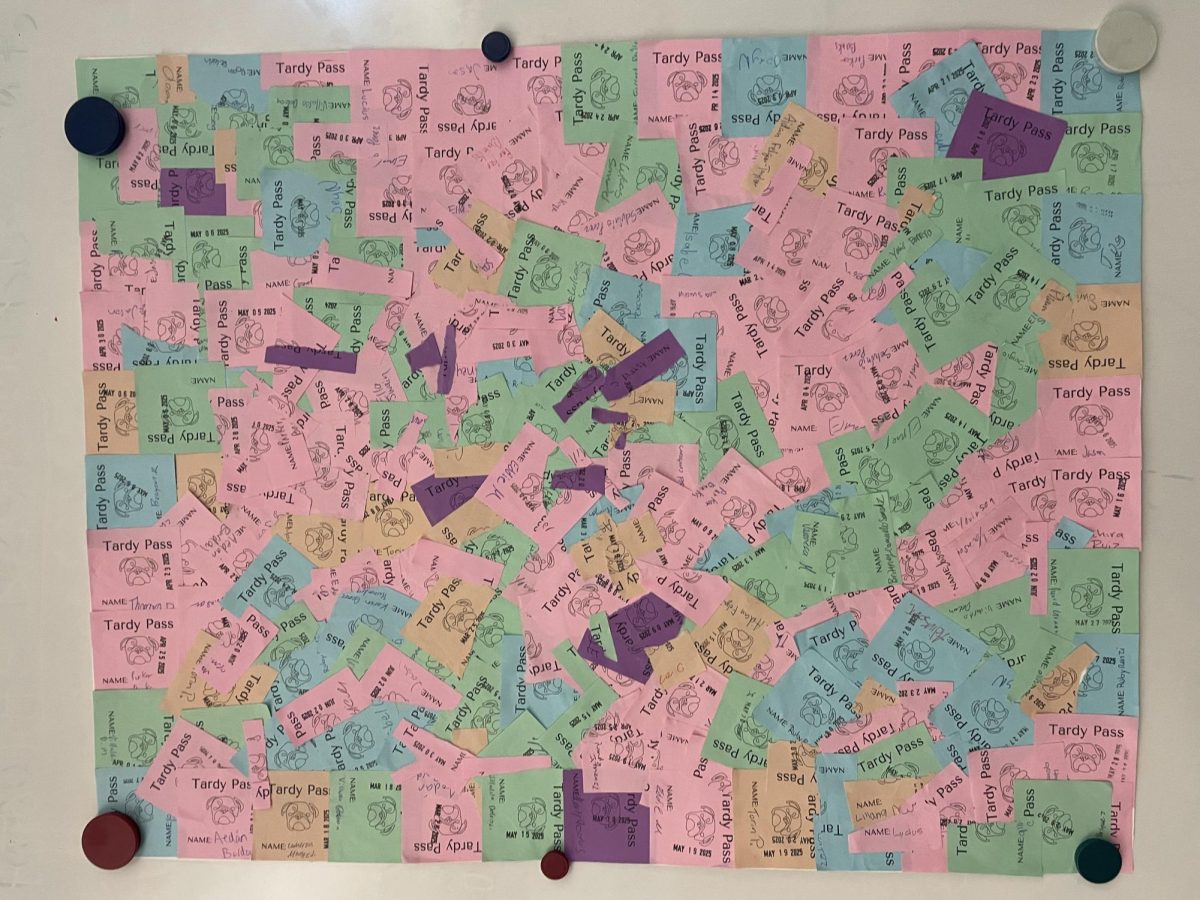

This year, FAFSA made major changes to its form to make it more user-friendly for high school seniors and their families. This delayed the form’s release date to late December rather than its usual release date of October 1st. The adjusted form includes fewer questions, a new section, and a slightly different formula for calculating eligibility for financial aid.

Unfortunately, the actual application process has suffered from a lot of bugs and glitches, which is affecting many schools with a big population of first-generation students whose parents may not have an SSN, including San Rafael High School.

“I have students whose parents have a SSN and their process has been pretty straight forward. However, when it comes to students whose parents don’t have a SSN, it has taken multiple meetings to [make very little progress],” said Judy Cordova from the Huckleberry College Equity Program.

“The population here at SRHS is being affected because there are a lot of people from Central America. It’s just the nature of the school,” said Juan Mercado Trujillo from the CCC.

These glitches are most common in the sections that involve the student’s contributor. “Contributor” is one of the new terms added to the FAFSA form which refers to someone who is asked to provide information on FAFSA. By default the student will be considered a contributor and the student’s parent(s) or step-parent(s) will be considered their other contributor.

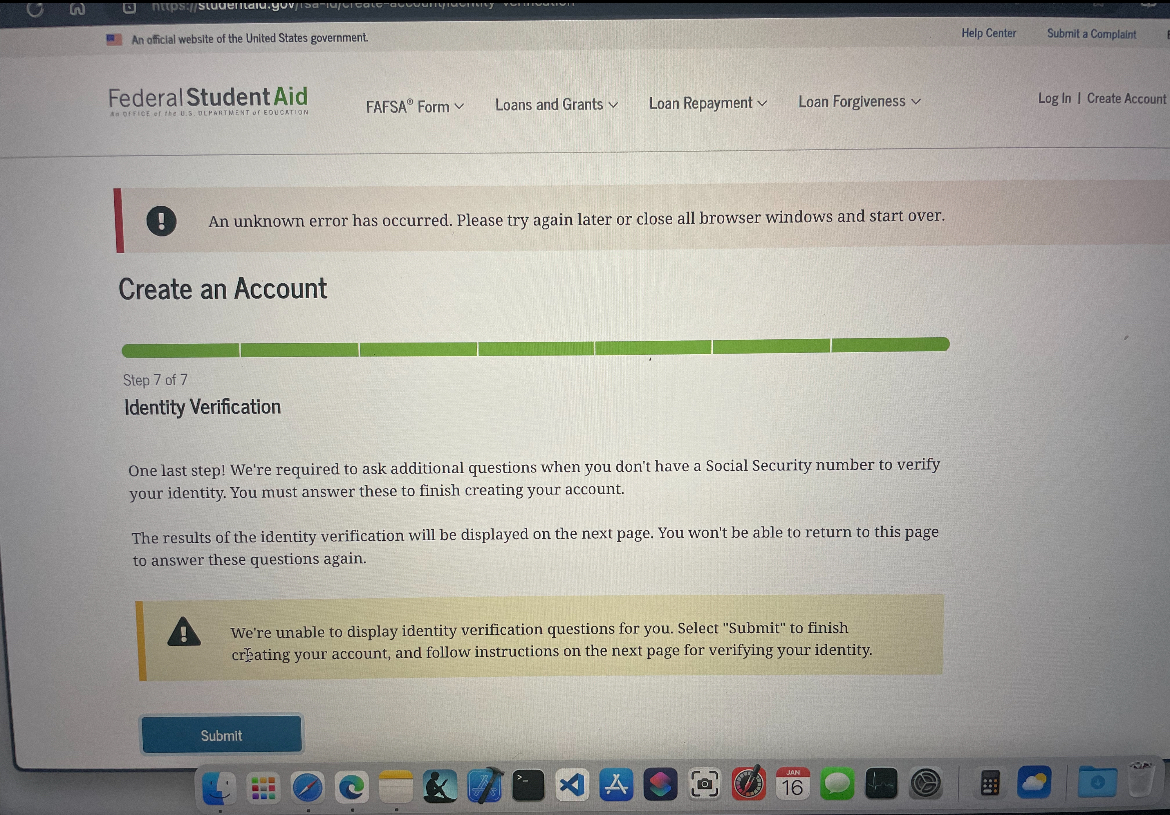

Now each contributor will need to create something called a FSA ID in order to log into the online FAFSA form. The process to make the ID will be different for those who don’t have a Social Security Number (SSN) which is where most of these glitches are located.

Some students were not able to create a FSA ID for their parents because it’d glitch them back to the home page when they select the box that their parent has no SSN. However, several students who were able to pass that step still face a similar glitch towards the end of creating the account. The last section is supposed to ask questions to confirm the parent’s identity since they couldn’t provide a SSN, but it doesn’t.

“I was able to get past a previous glitch I was experiencing in the beginning of creating the FSA ID for my parents, but then boom I still couldn’t turn it in and I was like what the heck […] it’s just very irritating,” said Angela Lopez.

For this type of error it was asked for the family to call FAFSA to ask them to verify the parents identity. When they answer they would tell you that an email would be sent asking for private information about the parents and email them back within 24 hours and wait 2-4 business days for them to verify. It worked for some, but it didn’t work for others, including me.

My mom and I had to wake up at 5 a.m. to call FAFSA to avoid the wait time and were expectedly told about the email and received it not that long after. We emailed them back with the information about my mom to confirm her identity right after the call. It had been a bit over a month by now and they still have not verified her identity. My mom regularly checked her email and had me double-check as well, but still nothing. I called again just to find out I missed the 14 day deadline that I was never told about.

Now I have to mindlessly wait, hoping they will verify my mom’s identity soon. It’s very tedious especially when I was told that all the changes in the form was to make it easier and faster. But that was not the case for me and for many other students whose parents don’t have a SSN. What most annoys me however is the fact that many other scholarships require their applicants to provide their FAFSA’s SAI. Which obviously is something I cannot provide because of these glitches. But I am lucky that some of these scholarships are lenient as they are aware of the issues in the FAFSA online application and allow us to put a placeholder for the time being.

Another glitch that occurs is at the very end of the actual FAFSA application where it is supposed to ask for the parent’s ITIN number. It’d ask the question, but the text box doesn’t appear so many students were prevented from finishing the form. Jaylee Avalos, a senior, confronted this issue herself and was very annoyed as this was quite literally the last thing she needed to do before turning in the form.

“It wouldn’t give me the box for a straight month and it wasn’t until two weeks ago that I was actually able to complete the form,” said Avalos.

All these errors and bugs are not only causing stress to students, but also to counselors who are helping students fill out the FAFSA form here in the CCC and in the Huckleberry College Equity Program:

“FAFSA has a lot of our students feeling nervous, feeling scared, frustrated. And it has me feeling all those feelings for the students as well and it’s just a scary time,” said Mercado Trujillo. “If you don’t know how much money you will be getting you won’t be able to know if you’re going to be able to afford that school you’re applying for and so it’s very scary to know that you might have to decide on a school without knowing the money situation.”

“Because of the population that we work with, most of their parents don’t have a SSN and no one is telling us when things are getting fixed so we are just waiting and anticipating and that’s the frustrating part,” said Yanet Medina from the Huckleberry program.

Despite all these hardships that many of the San Rafael High students are currently facing, FAFSA has created many changes that are generally good and beneficial, including the expanded criteria for Federal Pell Grant allowing even more students to qualify for it. More specifically, it will allow about 610,000 additional students in low-income families to qualify.

The number of questions in the form itself has also decreased immensely from over a hundred questions to a bit over forty questions. This was doable because FAFSA is now receiving the data needed about students directly from the Internal Revenue Service (IRS) to calculate students Federal Pell Grant eligibility and Student Aid Index (SAI).

What is SAI and what happened to Expected Family Contribution (EFC)?

SAI is the new version of EFC that still uses a similar formula to determine students’ financial aid eligibility, but with a few slight differences. One of which is that the SAI will now allow a negative SAI which will make it easier for fafsa and colleges to determine which students need financial aid the most, beyond those with zero SAI.

In the form itself, there is also a new section called, the Consent to Retrieve and Disclose Federal Tax Information. In this section, the contributor(s) will be asked to give their consent to provide their Federal Tax Information (FTI). If any contributor does not consent, the student’s SAI will not be calculated and the student will not be eligible to receive federal aid. Luckily, this does not seem to have been a problem here at SRHS.

The FAFSA changes had nothing but good intentions, however these were obscured by all the bugs in their online application, so once the trial and error comes to an end FAFSA’s attempts to make it easier for their applicants shall show.

”Our expectations were high because we did expect the application to be easier, not to have bumps,” said Cordova. “But overall, I have high hopes for next year that after all these tweaks are fixed, it will be that FAFSA that we expected.”