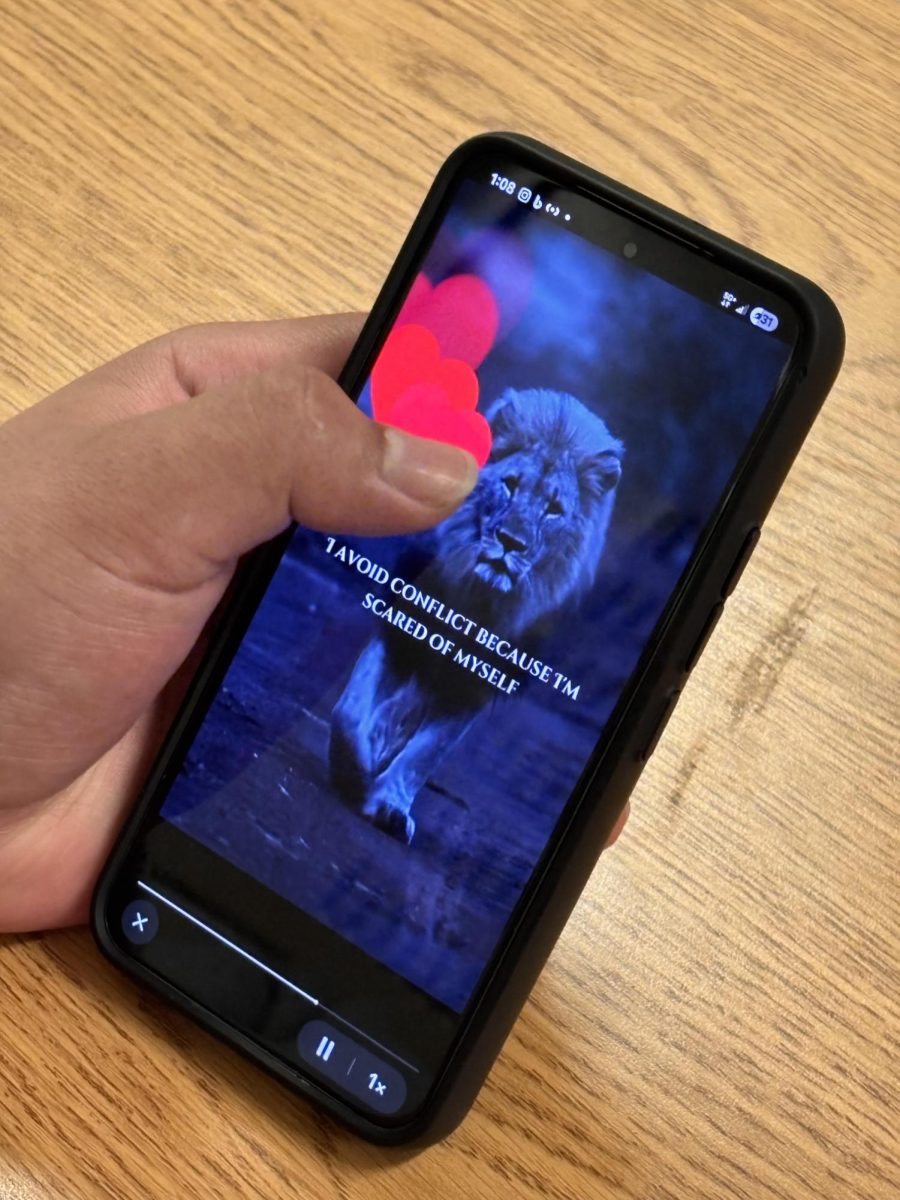

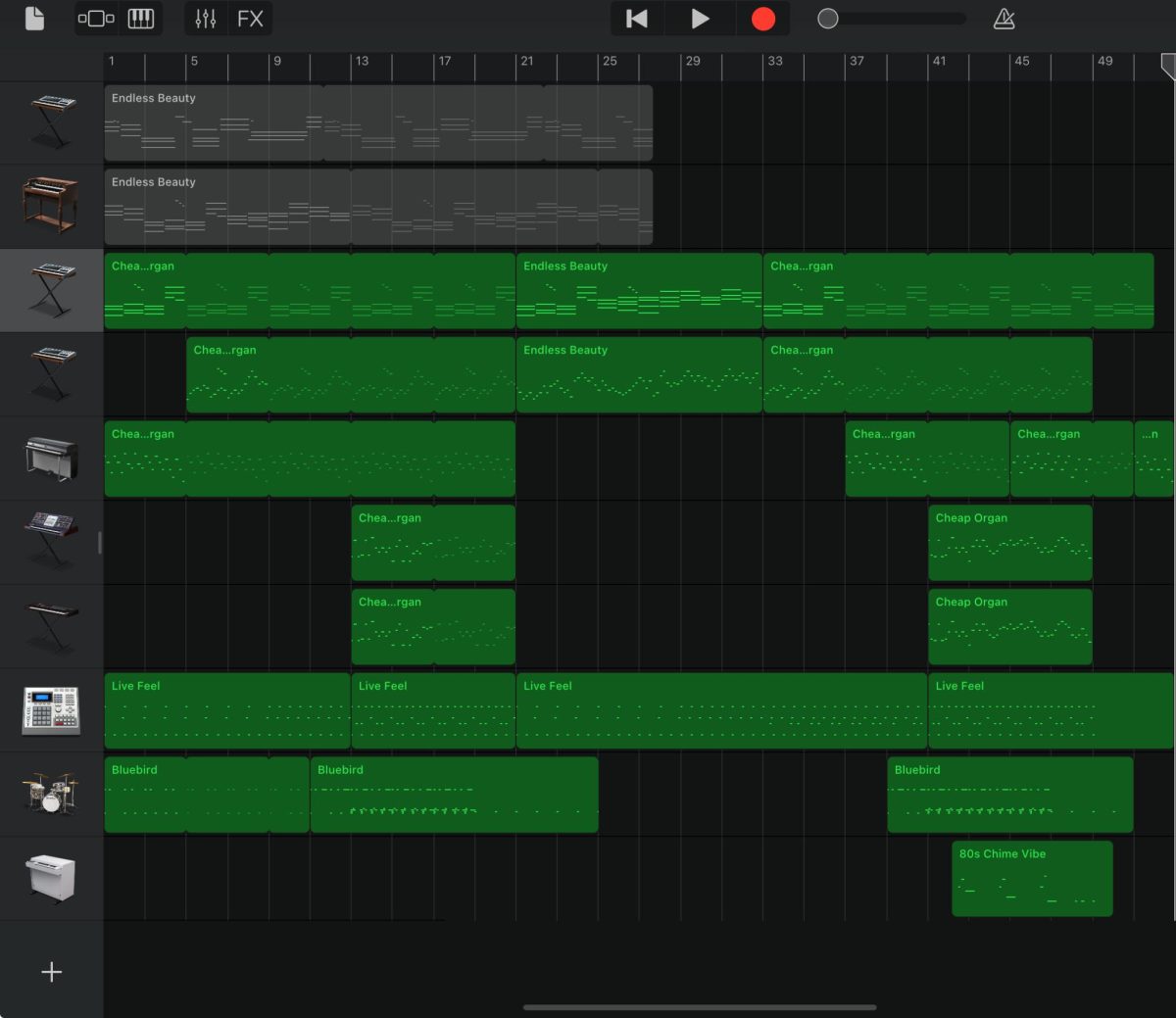

I was lying in bed late at night, scrolling through TikTok, and a video popped up that caught my attention. It was a video of this weird “Yeti” with a yellow mouth and teal fur. The video had text at the top saying “Day of a Trader.” In the video, the yeti yawns, stretches, and gets out of bed. He makes his bed and closes the curtains. He sits at his desk and logs on to his computer, which hums loudly because it is so old. The room looks drab with little decoration, but there are stacks of money lying around the room. Confidently leaning back in his chair, he seems pleased with himself, but as time passes, the money strewn around the room slowly starts to vanish. The yeti looks startled while watching it disappear for hours until there is nothing left. He stands up and paces around the room for a while, and seems to be agitated. He finally goes to bed angry and sad. I looked at the account, and in the description, they were advertising a Zerion wallet. The video had 89.9 million views. “Zerion wallet” is a platform that allows people to store, send, and receive cryptocurrencies.

Despite the overwhelming online presence of cryptocurrencies and memecoin culture, most students at SRHS remain unaware or skeptical, revealing a gap between digital hype and real world impact and exposing the dangers of financial manipulation targeting young people.

Cryptocurrencies have become a sensation online. You see it on Facebook, Twitter (X), Reddit, Google ads, Market Watch, virtually everywhere. Super Bowl ads, news stories about 13-year-old millionaires, and the influencers are all over the map touting the trend as the new gold rush, but despite what the media might tell you, crypto is not in every house. Individuals who don’t actively invest in the stock market, or who don’t keep up with the latest technology trends, tend to be skeptical of new ideas that receive negative press. Some countries have actually banned or restricted cryptocurrency, which keeps their citizens from even hearing about it.

Cryptocurrencies are an interesting concept, a new form of currency that the IRS treats as property and is very underregulated. With little regulation for these new currencies, it has opened the door for “Memecoins.” Memecoins are a form of cryptocurrency that essentially has no value. They are made for novelty rather than investment.

In simple terms, these Memecoins are gambling, same with stocks and all crypto. With their typically very short life span and fast fluctuation in value, the way you come out with profit is all about timing. If you’re not in on the “rug pull.” Rug pull is a term used to describe a common scam where you remove all of your coins at a fluctuating rate, leaving everyone else with less than they started with. It is impossible to know the timing for maximum profit, and if you push it too far, you will lose everything. You need to get out before the rug pulls, but make as much money as possible, hence, timing is everything.

We have talked a lot about how big crypto is online, but in our community, the online sensation was null. Out of 100 students questioned about if they knew cryptocurrencies beyond the surface, only two had a measured understanding. When asked about if they had heard Trumpcoin reports on the news or if they had seen an online video telling them they could “Get Rich Quick and Easy,” students around campus gave short answers:

“Like Dogecoin?”

“Didn’t Trump do something like that?”

“Is that the smiling monkey thing?”

“I have been seeing that on social media.”

“Joe Rogan was talking about that on his podcast.”

Most people had a rough grasp of what crypto was; they knew it was an online currency like stocks, but that was the extent of their understanding for most.

With a mission statement like “We aim to be the largest decentralized network in the world focused on creating, multiplying, and preserving wealth and opportunity for all entrepreneurs.” Belmar’s X account, https://x.com/lukebelmar, is mostly crypto related posts. Recently, with new sponsorships like Swissborg, he is enjoying showing off his wealth. Other people who fall under this umbrella to some extent are Michael J. Saylor, Andreas Antonopoulos.

Some students had a different perspective, though, like Yovinson Rodas, who said, “Isn’t it just gambling?” which was echoed and confirmed by another student, Callum Stewart, who told me that he has lost $10,000 in crypto investments. The other student, who wishes to remain anonymous, reported that he made upwards of $18,000 from committing rug pull scams. From the students I spoke with, the consensus was that Crypto is an unknown or gambling, with horrible odds.

We spoke with an SRHS alumnus who got into crypto before the first big boom, and these courses were not as common. Will Laviano, who graduated in the class of 2018, learned about cryptocurrencies through a friend of his who was a huge gamer. “I first heard about Bitcoin in high school through a classmate who was really into tech and gaming.” Like most people, Will did not fully understand the consequences of getting into crypto, only learned how things could not go one way, and was fascinated by making quick money. “I definitely didn’t fully understand the risks involved. I was more focused on the hype and the potential to make quick profits.”

Will quickly learned the risk and started to research how to manage the risks that he was taking. “It wasn’t until I experienced some losses that I realized how important it is to do proper research and manage risk,” he said.

Even if you avoid talking about students, there are estimated to be only 52 million Crypto wallets in the U.S., with many investors having multiple, which is essential for scams like the “rug pull.” With all things considered, there are not a lot of people in Crypto, with the census recording 340.1 million people in the US as of 2024.

The people in that 52 million are extroverted and, due to social media, appear to be a much larger group than they are. Luke Belmar, founder of Capital Club, a rags-to-riches young man from Argentina, shares his strategies through social media. As social media becomes more accessible, younger people start to see how these influencers are living their lives, and the people sharing their lifestyles don’t hold back; they love to show off. Fast cars, penthouses, luxury clothes, and luxury watches. When looking into them more, we start to see a trend of these people showing off their life of rented goods, and they sell courses so that younger people can become just like them. The reality is that these courses are just scams and are how they appear to be so wealthy. Belmar is well known for his strong opinions, his lifestyle, his Crypto wallet, and his involvement with the Capital Club.

The people in that 52 million are extroverted and, due to social media, appear to be a much larger group than they are. Luke Belmar, founder of Capital Club, a rags-to-riches young man from Argentina, shares his strategies through social media. As social media becomes more accessible, younger people start to see how these influencers are living their lives, and the people sharing their lifestyles don’t hold back; they love to show off. Fast cars, penthouses, luxury clothes, and luxury watches. When looking into them more, we start to see a trend of these people showing off their life of rented goods, and they sell courses so that younger people can become just like them. The reality is that these courses are just scams and are how they appear to be so wealthy. Belmar is well known for his strong opinions, his lifestyle, his Crypto wallet, and his involvement with the Capital Club.

Where do these people make these fraudulent coins? Pump.fun is a website connected to the Solana blockchain, which allows people to easily make coins, which is why when you first launch the website, the first thing you see is a bunch of coins that people have made based on memes or anything that is popular at that time. People make coins to rug pull them. It costs nothing to make a coin on the pump.fun site, so when you make one of these rug pulls, it’s all 100% profits that are coming in when you pull one of these scams off.

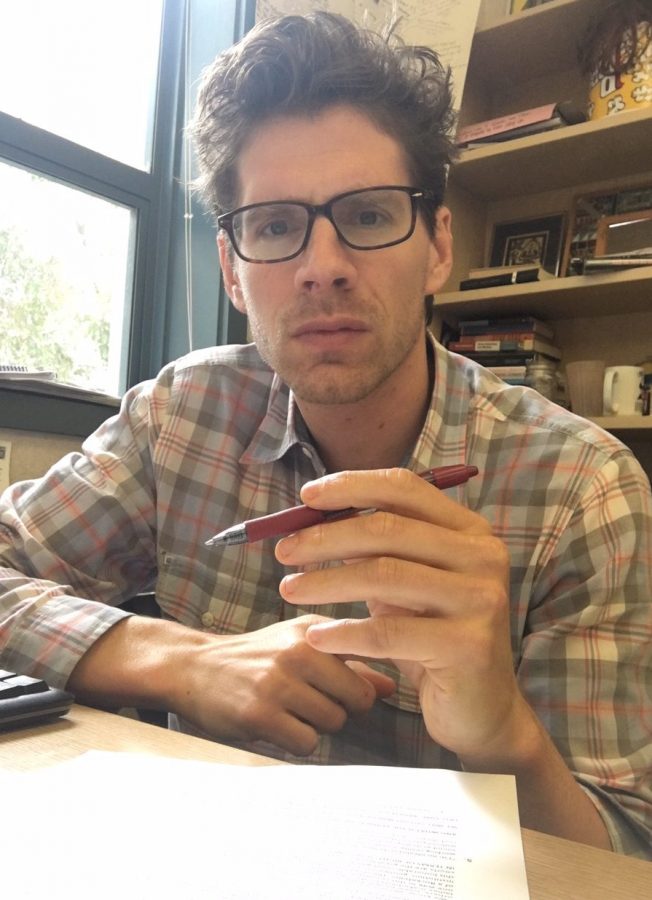

We decided to speak with Assistant Professor of Economics at Eckerd College, Sarah Parlor Dean, to see what she was researching pertaining to memecoins, where and why people fall for these scams. Dr. Dean said, “A lot of the scams that can occur with crypto are because people might not understand how they work.”

I spoke with someone online whom I met on Discord, a chatting app for communities. I met them on r/Wallstreetbets official Discord when I was hunting around for someone to talk to. I was hopping around sending messages, hoping to find someone to talk to, but not really expecting to. Then “RaF” messaged me back, “Wait, so why are you doing this? Like, what do you need it for?” I told them, “It’s for an article I am writing,” and they agreed to hop into a voice chat with me for a bit.

They sounded younger just in their tone, and later they told me that they were 20. They were interning full-time at a tech company when we spoke, but they said they were going back to classes within the month. For their privacy, they asked me not to disclose the company or school they were attending. I was trying to keep it conversational, but eventually we made it around to more of what I was looking for. They told me that they were currently up around $7,000 in crypto earnings, but they were previously down over $20,000. They started trading in their senior year of high school and lost a lot of money because they were “listening to all the crypto gurus on YouTube.” But they started thinking for themselves and made a bunch of money, and went on a spending spree. “Yeah, I was really into CSGO Cases for a while,” said RaF.

For anyone who doesn’t know CSGO is a video game with a gambling and item trading market that is closely connected to real money with one Item selling for around $2 million dollars. RaF admitted that he has a gambling problem and that connects to his love for Memecoins.

“Yeah, it was really easy. One day, I saw a video talking about all the money in crypto and how ‘this coin is going to the moon’ or something like that and I made a wallet on Crypto.com and put 20 bucks on the coin in the video that was around like ten a shares, so I got two just to see. Later that day, “I think it was around $100, and it hooked me so I took my $200 and put it in a different coin that was trending up, and when I went to check on it, my $200 had turned into $1.34.” “Crypto was never big like in high school or in real life in general. The only time I would really talk about it was with one of my friends who started trading after me, or online.”

There are quite a few dangerous ways to lose your money. It is also a big mental game. It is dangerous when you put in all the money you have saved and are taking a leap of faith, only to have it taken. It’s gambling, you win some and you lose some. But that may be too much for people. Arnold Haro, also known as @MistaFu*cYou on X, was a 23 year old male who tragically took his own life while on a livestream. Blockchain data showed that Haro purchased 80,085 $ye coins worth around $500+ around the time he purchased the pump.fun coin. He then later lost all of that money and was left with nothing in his account. Later in the live, he starts to play Russian roulette, “ If I f**king die, make it a memecoin.” Haro said. This whole live stream was on X, and as soon as the news broke, the memecoins with Haro’s name on them were taking over the whole site. These were no small coins, their market cap went way over $1 million.

We spoke to a gambling therapist to teach us about what goes on in the minds of younger people when they take big risks and, unfortunately, face the consequences of their gambling. Michael Skrodzki is a licensed therapist who specializes in gambling addictions in the Marin area. “The adolescent brain is wired for risk taking,” he said. “Unfortunately, when they don’t win, they have this little voice where their ego takes over, which leads to actions that they would not take in their normal state.” When asked what he taught about the unfortunate situation of Haro, he stated, “When someone takes a risk like Haro did, which was unfortunately putting in all that he had, he felt as if he had nothing left, which is when that voice that I was talking about took over. I feel sorry for the boy.”

We found many reports of people’s losses online via Reddit r/wallstreetbets. Specific examples of losses in the cryptocurrency world include the 2022 crypto case, where it was reported in a study that investors who bought Bitcoin above $20,000 in 2021 saw a 50% loss by December 2022. The collapse of the FTX exchange in 2022 wiped out $8.9 billion of its investor’s savings, which was caused by a hacker who got away with $477 million. The elderly are frequently subject to scam artists bilking them out of millions of dollars.

People flex their winnings online with real life, changing money. I have seen people with over 1+ million dollars in their wallets online, most of which is made from rug pulls. It’s very easy to learn how to make these coins. Someone can look up on YouTube right now “How to rugpull,” and you will, in less than 10 minutes, fully learn the basics on how to launch your own coin.

Crimes are starting to get physical and very dangerous, though there is a blockchain, it’s very hard to find where coins are going and to whom. It’s getting to a point where, once a week, you hear on the news of an attack on someone who owns some sort of crypto. These criminals don’t play games, they will do anything to get that sweet semi untraceable currency. They will go after your family to get leverage to blackmail.

While there are evidently students who do trade Crypto at San Rafael High School, the numbers remain surprisingly low considering the overwhelming presence of Crypto in spaces for young adults. Some of that can be attributed to shyness or embarrassment, especially if they have lost money trading. Even with that caveat, the numbers are still low. We can estimate 1/100 SR students’ trade based on our pool of interviews. Even if our numbers don’t fully reflect the amount of students who do crypto, it’s clear that it hasn’t fully caught on at SRHS.

Pat • Jun 5, 2025 at 7:21 pm

Great article ,Very informative , I learned a lot thank you.