SRHS Seniors Face the Challenge of Paying for College

November 26, 2018

The fall semester of senior year is a very stressful time for many high school students. According to the National Center for Education Statistics, the average cost of all private and public institutions has increased from $8,800 per year in 1995–96 to $22,432 per year in 2015–16. This means that today’s students are facing the challenge of raising over twice the amount of money for their educations than the generation before. Thankfully many resources are available to help students obtain the aid they need before deadlines arrive.

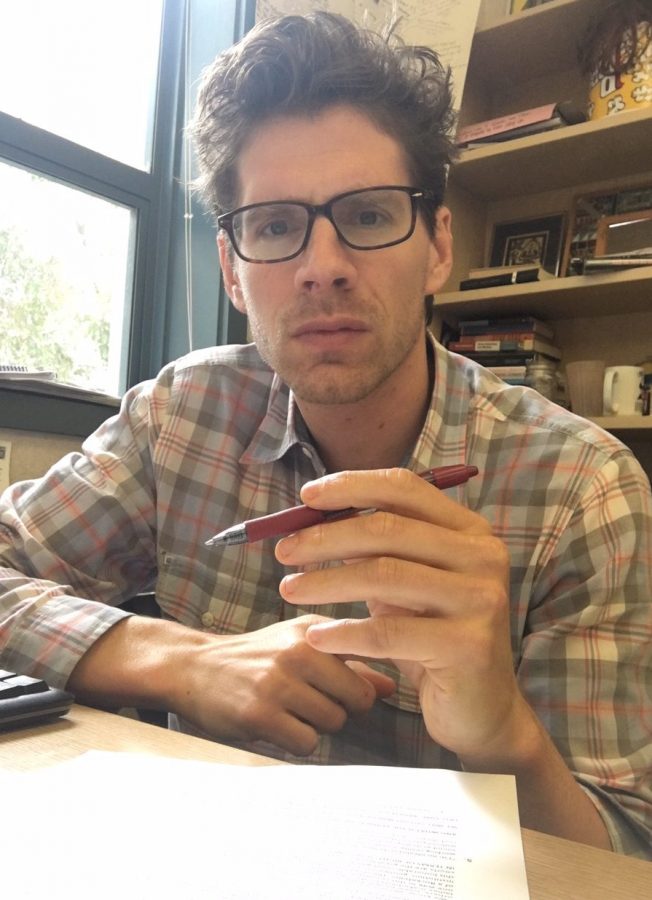

“It’s hard because (students) have so much going on senior year,” said Ms. Mazariegos, college advisor at San Rafael High School’s College and Career Center. However, she was adamant that “being proactive” can make a massive difference in how much financial aid a student receives.

As national student debt hit $1.5 trillion this year, college admissions season is not just about college essays or the Common App. Instead, the most important part of many students’ futures is arguably scholarship deadlines, both locally and nationally. Scholarships are the preferred method of keeping students debt-free, while still allowing them a wide variety of college choices.

Many students begin to focus on their future as autumn and winter approach. However, Quint Fain, a senior at SRHS, has been working on his applications for financial aid since early July.

After visiting junior year, he decided that Georgia Institute of Technology was the perfect school for him, yet, like many schools in the United States, the out-of-state tuition comes to just short of $50,000 per year.

Struggling with the terrifying thought of student debt, Fain decided to turn to the government, specifically the military.

He applied to the Air Force, Navy, and Army Reserve Officers’ Training Corps (ROTC) programs in the hopes of receiving the elusive Tier 1 scholarship (only 5% of nationwide applicants receive this type of scholarship), which would completely cover his tuition.

After multiple meetings with army officers, constant email and phone contact with an ROTC officer, and extensive work on his application, Fain recently was awarded the Navy Tier 1 Scholarship.

Now that he has been accepted, he will have to serve four to six years of active duty after college with three physical training days, two military strategy classes, and one three hour drill session per week during college.

Some may wonder why a high school student would make such a commitment before even finishing the first semester of senior year.

The truth is that for Fain and so many other students across the country, these commitments are often the best solution for affording higher education.

Dorrell Thompson, a 2017 graduate from SRHS, currently attends Lewis and Clark College in Portland, Oregon.

“The education I am receiving is incredible,” said Thompson, when asked if the costs of college are worth it. “Professors are dedicated to learning and research and being part of such an enriching environment is completely worth the cost.”

She continues to say that there are many extra perks included in tuition, like opportunities to study abroad, go on weekend trips, and make use of “the free services on campus.”

However, with an undergraduate tuition and fees of about $45,000 in 2015–2016, should the services and opportunities provided by Lewis and Clark College be considered “free,” or simply expected?

In her time as a college advisor, Mazariegos has met with many students who were incredibly excited to go to an expensive private college, even with the prospect of debt. In these situations, it is important to keep students informed about their options because while there is something to be said about the opportunities a fancy private school can offer you, community college and state schools can put you on a similar path, with a much lower cost.

Zoe Hauser, another SRHS alumna, attends Cornell University. With a price tag of $70,000 per year, she’s looking at a graduate degree that will cost her more than a quarter of a million dollars.

Even with parents “who value education and who have saved since the day (she) was born for (her) college tuition,” Cornell has put a massive burden on her family, and plans to attend law school will definitely force Hauser into taking loans.

So, why is Hauser paying so much for college in the first place? Many would believe that all attendees of such a prestigious school as Cornell could obtain quite significant scholarships.

The sad truth is that income restrictions often deprive higher-income students of aid.

“Cornell does have great financial aid programs that help low-income students,” stated Hauser. However, “a large percentage of students still deal with the burden of paying the extremely high cost of attendance.”

On the flip side, need-based financial aid is a necessity. Melissa Caballero, a senior at SRHS, informed me she specifically chose to apply to some colleges because they would cover most of her tuition if accepted. Caballero is also applying for a 10,000 Degrees scholarship in hopes of getting more help affording college.

Sindy Guevara, also a senior at SRHS, is in the same boat. She has applied to 10,000 Degrees, completed her FAFSA and College Scholarship Service (CSS) profile. She is also hoping for a work-study opportunity at Scripps College if admitted. Guevara also stated, “People of low income rely solely on financial aid and grants because they can’t pay back loans.”

Perhaps in the future, the trend of rising tuitions will flip and students will begin to regain financial stability. However, as the graduating class of 2019 approaches college decisions that every class before and after has, it is important to remember one thing.

“There’s a lot of money out there,” said Mazariegos, “it’s about being proactive.”

In other words, if you need money for college, put yourself out there: volunteer, play sports, check in with college advisors, support the community. You can do it.